2nd Q2 Featured Founder | Cadence OTC

The 2nd New Majority founder currently fundraising from YOU this quarter.

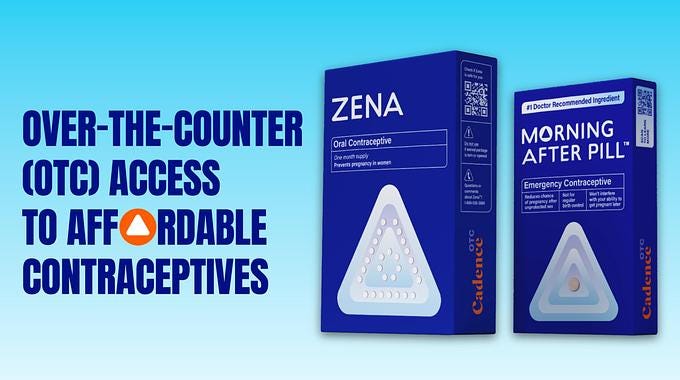

This week’s Featured Founder, Cadence OTC, is pioneering a more accessible, empowering approach to reproductive health!

Cadence OTC

First, some context:

😟⏳Have you ever realized that you’re on the final week of your pill pack, but don’t have any refills or time to get a new prescription from your primary care practitioner?

🤔🤷♀️ Or, if you’re one of the 19m reproductive-aged women in the US living in a “contraceptive desert,” have you found it difficult to access any oral or emergency contraceptives?

🌵“Contraceptive deserts” are areas where individuals do not have reasonable access to contraceptive options, whether limited by price or distance to a health center. This is especially important for uninsured individuals, who often rely on publicly funded health centers to meet their reproductive health needs (Source: Power to Decide).

🤯💰The US reproductive health industry was worth $21b in 2022 (Source: Nova One Advisor).

👥In 2018, around 30m women of reproductive age in the US were in the market for contraceptives (Source: Guttmacher Institute), representing a $12b contraceptive market by 2030 (Source: Research and Markets).

🐌🩺Yet accessing contraceptives in the US can be difficult; price, the need for a prescription, and convoluted insurance systems are all hurdles to obtaining birth control.

💊The formulations for oral contraceptives/birth control pills (“The Pill”) and emergency contraceptives (“The Morning After Pill”) have been around since the 1960s, but the Pill has historically only been available with a prescription. A levonorgestrel emergency contraceptive (aka Plan B) has been available for unrestricted over the counter purchase (under the name Plan B/Plan B One-Step) since 2013 for $40-$50 (Source: Planned Parenthood).

🧪🪄Making medications available over the counter (known as the Rx-to-OTC switch process) is one way to increase access and lower prices – this is where Cadence OTC comes in!

💡Cadence is at the forefront of the Rx-to-OTC switch process for contraceptives, aiming to expand seamless access to oral and emergency contraceptives.

🧐The Rx-to-OTC switch process has become an established pathway to broaden access to existing prescription drugs, from allergy meds like Xyzal and Zyrtec to acne face washes like low-strength Differin (Source: GoodRx). With FDA approval, the Rx-to-OTC switch process ensures that everyday consumers can properly use a medication without a physician’s guidance, negating the need for a prescription.

Tell me more:

🧩Cadence OTC is applying the proven Rx-to-OTC prescription switch process to a huge and largely untapped market focused on women. Cadence is democratizing access to contraceptives that will enable people to make their own reproductive health choices, improving reproductive health outcomes for the millions of Americans who live in “contraceptive deserts,” are uninsured, or simply need access to birth control in a pinch.

THE DETAILS

Industry: Wellness, E-Commerce

Impact: Good Health and Well-Being (SDG 3), Gender Equality (SDG 5)

Team Diversity: Woman Co-Founder, BIPOC Co-Founder

HQ: Oakland, CA

Company size: 2-10

Year founded: 2014

Key investors: A variety of impressive institutional investors back Cadence OTC.

Soros Economic Development Fund: The SEDF invests in companies focusing on “an open society challenge or opportunity,” from environmental causes to companies expanding medical access (like Cadence OTC). As of 2021, the SEDF had deployed over $400m of capital to its portfolio of companies.

RH Capital: RH Capital is a women-led firm that invests in companies pioneering new approaches to women’s health. RH’s portfolio includes companies like Cofertility (building a modern, equitable process for egg freezing and egg donation) and Ovia Health (a maternity and parenting digital health platform acquired by Labcorp in 2021).

Other institutional investors include Gratitude Railroad and the Global Fund for Women, and individual investors include actress Elizabeth Banks and the Disney family.

Investment type: Convertible Note*

*A Convertible Note is debt that converts to equity in the future. The amount of shares you receive is typically determined either 1) after future fundraising that sets a price for preferred stock or 2) after the note reaches its maturity date. The shares received from a convertible note typically convert at a lower price than the preferred stock (meaning you get a discount aka more shares for your earlier investment). If the convertible note reaches its maturity date, you typically receive equity at a previously set price.

💸 Valuation: $73m

Investor Perks: For your investment of $500, Cadence OTC will donate 5 packs of Morning After Pills to a public clinic. You’ll also get a piece of Cadence OTC swag!

Cadence OTC is raising $10m, including $1m raised in a side-by-side round with the same terms as their current crowdfunding campaign. The Soros Economic Development Fund has committed $5m, pending a successful raise of $3m from other investors (as of April 24 at $1,366,570)

Amount Invested: $1,366,570

Number of Investors: 182

Min investment: $250

Goal: Cadence OTC has already surpassed their minimum funding goal, but they have not set a max target.

Deadline: April 29th (5 days and counting!)

Early traction:

🆕🎯Cadence OTC has a strong product pipeline, building off of the momentum of the Morning After Pill launch this past January after piloting the Rx-to-OTC switch process for contraceptives. The Morning After Pill is Cadence’s first commercial product, 10 years in the making.

📈🔥Cadence’s levonorgestrel Morning After Pill has already demonstrated a clear market fit, with a predicted $3m revenue run rate in its first year of sales and retailing at an affordable $19.95.

🔜Early detection pregnancy tests and UTI relief kits are set to launch in Q4 2024, helping Cadence reach a wider audience and build their DTC and retail revenue streams. These products do not need to go through the Rx-to-OTC switch process!

🤝Cadence plans to launch Zena, their OTC version of The Pill combination oral contraceptive, in 2026. Zena is on its way to obtaining FDA approval, with the next step being an actual use trial.

🔑Cadence OTC has secured an exclusive partnership with a major healthcare distributor (Lil’ Drug Store) to get Cadence products in 150k+ convenience stores across the US.

🛒Cadence’s Morning After Pill is already available in popular convenience stores like 7-Eleven and Circle K.

📌🏆Pending FDA approval of Zena, Cadence OTC should receive three years of market exclusivity. Cadence is not the first mover in OTC birth control pills, but they hold the rights to three prescription oral contraceptive formulas and will be the first to bring a combination pill to OTC.

🔼⚙️Cadence also holds trademarks for Zena’s packaging. Zena blister packs will be triangular and more clearly distinguish between placebo and active pills, minimizing user error and manufacturing mishaps.

Founding Team: Cadence OTC’s founding team includes a repeat founder and decades of combined experience in startups and biotech.

Samantha Miller (Co-Founder, CEO): Samantha Miller is also an advisor and board member for a range of pharmaceutical and biotech companies, combining her biochemistry and immunology/microbiology know-how with business savvy.

Dr. Nap Hosang (Co-Founder, Chief Medical Officer): Dr. Nap Hosang is a former OBGYN, whose work prior to Cadence OTC focused on reducing maternal and infant mortality rates. Dr. Hosang spent much of his 30 year practicing career at Kaiser Permanente and was a lecturer at UC Berkeley’s School of Public Health.

Dr. Malcom Potts (Co-Founder, Scientific Advisor): Dr. Malcolm Potts has been a pivotal pioneer at the intersection of public and reproductive health since the 1960s, working with state governments, the International Planned Parenthood Federation, and Family Health International, among other prestigious board and director positions. Dr. Potts has advocated for the development and expansion of safe contraceptive and abortion practices, and is known for stating that “pills should be in vending machines and cigarettes on prescription.”

DUE DILIGENCE

Pros:

🚀Despite only going to market with their first commercial product (the Morning After Pill) in 2024, Cadence OTC is projecting profitability by the end of 2025.

💵Early detection pregnancy tests and UTI relief kits will join the Morning After Pill to propel Cadence to profitability before launching their “hero” product, the Zena combination birth control pill, in 2026.

🙌Because Cadence products are available for purchase without a prescription or insurance, they can reach the 19m customer base of would-be birth control users living in “contraceptive deserts.”

⚖️Cadence also prides themselves on their accessible prices; Cadence’s Morning After Pill retails for half the price of other OTC emergency contraceptives.

💥Target Market: Cadence has a vast potential target market of 28m reproductive aged people in the US seeking birth control (including the 19m who live in “contraceptive deserts”).

✅For uninsured customers: given the accessible cost of Cadence’s Morning After Pill (and eventually Zena), obtaining birth control through Cadence is both efficient and cost effective.

⏰For insured customers: while most insured customers would continue to obtain a covered birth control prescription through their primary care practitioner, Cadence can be a convenient alternative in the event that their usual method of obtaining a birth control prescription falls through.

👀🧬Cadence has gone through the time-consuming process of establishing an Rx-to-OTC switch process as a pathway to increasing contraceptive accessibility. Subsequent FDA approvals for commercial products should become quicker. Ultimately, Cadence’s potential market encompasses a combined $21b market for reproductive health products, from emergency contraceptives to pregnancy test kits.

Potential Risks:

⚠️⏸While Cadence's OTC Morning After Pill received FDA approval, there's no guarantee that the Zena birth control pill will receive approval.

🛑🚫Reproductive health has also been the subject of heated political battles in recent years, which could result in restrictions on the sale of birth control and emergency contraceptives and restrict Cadence’s ability to reach their target market.

🚧😳Cadence has taken steps to minimize manufacturing, packaging, and user error risks, but a potential recall could damage Cadence’s image/reputation.

🤹♀️☔️Cadence has ambitious revenue projections, but are relying on numbers from their first (and to date, only) commercial product launch in January 2024. Cadence could fail to meet revenue targets if future products do not perform as anticipated.

Competitors: For OTC oral contraceptives/birth control, Cadence is an early mover with a huge target market, but not the first to market.

🤼♀️Opill: Opill obtained FDA approval in 2023 (through the same Rx-to-OTC process Cadence plans to employ for Zena), but only went to market in the US in March 2024. Opill is progestin-only, a formulation which accounts for only 6% of oral contraceptive prescriptions in the US (Source: NIH). Cadence’s Zena will use a combination formula of estrogen and progesterone, which accounts for the other 94% of oral contraceptive prescriptions in the US.

🆚Read more about oral contraceptive/birth control pill formulations here to understand key differences between Opill and Zena.

🗯Read more about generic and brand name medication formulations here. Generic formulations of brand name drugs contain the same active ingredients, making them safe and efficacious, but generic drugs can be sold at a lower price after the patent for the brand name drug expires.

Why Cadence OTC:

Pioneering the Rx-to-OTC switch process for contraceptives, Cadence is making “the Pill” as simple to purchase as condoms. With strong revenue projections and a product pipeline that extends beyond the morning after pill and birth control, Cadence is primed to capture a significant portion of the $12b contraceptive market and a $21b reproductive health market.