The New Majority Portfolio Wrapped

🎉 As we approach the end of 2023, we're analyzing and celebrating The New Majority portfolio we’ve curated.

👋 Hello New Majority Investor Circle,

As we approach the end of 2023, it's time to reflect on The New Majority portfolio we’ve curated. As a quick reminder criteria for companies to be featured include:

New Majority (co-) founded

Currently raising through debt or equity crowdfunding (open to investment from non-accredited investors)

Impact built into the business model (as measured by the UN SDGs)

Strong business model, traction, large market opportunity, and well-positioned team

🧐 Before we jump in, it’s worth noting that funding stats for New Majority founded companies in the VC space didn’t do much to buck the abysmal historic trends, the economic landscape for startups looking to raise got a lot harder in the last year, and to top it off, the odds of success for any business, let alone one that fits the growth-profile for equity investments, are still quite low.

Less than 3% of all VC investments went to women-led startups and even less to BIPOC and LGBTQ+ led startups

In 2023, funding was down generally, but capital invested into female founded or co-founded companies dropped by 50% compared with 2021 (Pitchbook).

Women account for less than 15% of the check-writers and studies show that companies raising from women investors may actually make it harder for these companies to raise additional rounds of funding in the future (HBR).

The funding gap for New Majority founders persists across the startup journey from pre-revenue through exit (McKinsey), and leaves significant potential returns on the table with New Majority founded companies achieving 30% higher returns for investors upon exit than White male founder counterparts (Kauffman).

Survival rates of new businesses have remained consistent over time - by year 5, about 50% will still be in business.

⬇️ With this (slightly depressing) context in mind, we’re excited to break down and celebrate The New Majority portfolio, an inspiring group of New Majority founders building impactful companies. Below are key highlights, notable wins for our portfolio, impact milestones, and our personal reflections.

Key Highlights

💰 Raised: The New Majority 2023 Portfolio includes 20 companies that have raised over $24.2M from over 13,500 investors alongside institutional funders including the Fearless Fund, the National Science Foundation, and Andreessen Horowitz.

👭 New Majority founders are increasingly embracing equity and debt crowdfunding as viable fundraising channels.

🙋♀️ Gender: 15 out of our 20 companies are founded by women. Worthy of celebrating even more given VC funding rates for all-female founding teams is less than 3% (HKS).

🌎 Geographic Reach: Our portfolio showcases notable successes and wins on both domestic and international fronts that underscore the global impact of The New Majority.

✅ SDGs: 12 of the 17 SDGs are represented in our portfolio.

📝 Investment Type: 45% of companies we featured chose Simple Agreements for Future Equity (SAFEs) or Crowd SAFE structures as their preferred investment type for their equity crowdfunding raise.

In a strategic move to diversify our portfolio, we featured New Majority founders raising capital through debt vehicles. 2 of the 20 companies we featured utilized bonds on platforms like Honeycomb Credit and SMBX, and both have begun paying back their investors with a 100% on time rate thus far.

📣 Platform: Wefunder emerged as the preferred platform for fundraising among our selected featured companies, with 45% choosing it as their launchpad for financial success.

Portfolio Stats

💰 Total Raised: $24.2M 💰

The New Majority 2023 Portfolio includes 20 companies that have raised over $24.2M from over 13,500 investors alongside institutional funders including the Fearless Fund, the National Science Foundation, and Andreessen Horowitz.

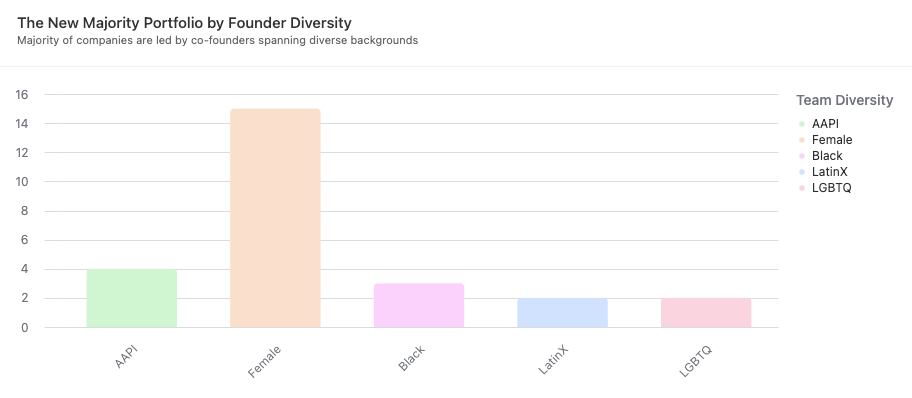

👍 Founder Diversity: Highlighting our commitment to a diverse and inclusive entrepreneurial landscape that makes it easier for everyday New Majority investors to invest directly into founders who look like them, 15 of the 20 portfolio companies are led by female founders or co-founders and 11 are led by BIPOC founders. Additionally, 2 of the 20 founders identify as LGBTQ+. See the charts below for a more detailed breakdown of founder diversity.

👷♀️ Industries Supported: The top 3 industries across TNM portfolio included: tech (9), food & beverage (5), and consumer packaged goods (4).

🌱 Sustainable Development Goals: Supporting our hypothesis that New Majority founded companies are also more likely to build businesses that support positive social change, the companies we featured this year collectively align with 12 of the 17 UN Sustainable Development Goals (SDGs). The SDGs that were most common included:

SDG 12 - Responsible Consumption and Production (8 companies)

SDG 3 - Good Health and Well Being (6)

And a three way tie between SDG 13 - Climate Action (4), SDG 9 - Industry, Innovation, and Infrastructure (4) & SDG 10 - Reduced Inequalities (4)

🌎 Geography: With an unintentional focus on domestic companies (primarily due to the types of companies that can raise on the top equity crowdfunding platforms), companies were headquartered across multiple states, with New York City and Washington, D.C. standing out as top entrepreneurial cities. By state, California was the primary home to The New Majority portfolio companies. It’s worth noting that many of the companies are poised for international growth or currently in international markets with global impact.

Portfolio Valuation

The New Majority interns spent a significant portion of this semester assessing the value of The New Majority portfolio as it’s difficult to accurately assess the value of private companies. The true value depends on market conditions, competitors, and consumer preferences, and can be calculated by multiple methods (HBS). The valuation methodology and process involved a comprehensive examination of several factors including:

$ Valuation When Featured: Capturing the company valuation at the time they were featured by The New Majority.

$ Valuation At Present: An assessment of the company’s current valuation.

Other Qualitative Information: Beyond the numerical metrics, our evaluation embraced the qualitative aspects such as successes, wins, and notable achievements.

% of equity based on individual investment

With the last criteria being unknown given it’s up to each New Majority subscriber and member to make their own judgements, the valuation we landed on was benchmarking the portfolio valuation based on the valuation caps at time of raise.

💵 Final Valuation: $970M 💵

TNM Portfolio Successes & Updates:

The Cru was acquired by Luminary! This was the first acquisition in the New Majority’s portfolio. Listen to our podcast about The Cru here.

BabyQuip raised over $1M on StartEngine. Listen to our podcast featuring BabyQuip’s founder and a quality provider here.

Tomu, a hospitality development company focused on sustainability, celebrated wins including a new production facility, recognition at the Hospitality Design Awards, and the prestigious ICC-NTA certification, emphasizing safety, sustainability, and resilience in their structures.

Substack is expanding their podcast offerings and introducing AI driven- content and creator videos.

Throne is expanding rapidly! They partnered with LA Metro, and gained widespread media attention from their successful LA Metro debut, with four bathrooms recording 1171 uses in the first week, engaging 120 metro operations, and achieving a 64% repeated usage rate. They are leveraging their $5.1 billion annual budget, and aim to expand to 147 locations ahead of the 2028 Olympics. Throne also secured approvals for a Manhattan Pilot, gained budget approval for Smart Bathrooms in NYC, and is on track for a significant deployment in Ann Arbor with a pending City Council vote.

Sun & Swell was the winner of the Google Single Use Plastics Challenge and will now be testing their products at select Google foodspaces.

Painterland Sisters was recognized by the 2024 Forbes 30 Under 30 Food & Drink list, spotlighting rising stars in restaurants, farming, packaged food, alcohol, and recipe development who have persevered despite the odds.

Clockwork has successfully raised over $1 million, and their campaign is currently oversubscribed demonstrating the overwhelming support from investors.

Top Podcast Episodes

🎧 The New Majority Investor Circle Podcast: Building on our belief that the founder and founding team are critical to a company’s evolution through pivots and growth, combined with our deep passion for storytelling as a way to build connections, this year we launched The New Majority Investor Circle podcast. Through this podcast, we sought to build a direct connection between New Majority investors and New Majority founders. In 2023, we released 7 episodes with 7 incredible founders.

Top 🥉 Podcasts by Downloads:

Share Your Feedback With Us and Receive 1 3️⃣ Months Free Membership!

At The New Majority, we are committed to continuously improving our offerings to better serve you. Your feedback is incredibly valuable to us, and it will help us understand your preferences and needs.

The survey is designed to gather your thoughts on your experience with The New Majority Newsletter and Podcast, as well as your motivations for investing in women, People of Color, and LGBTQ-owned companies. Your responses will remain confidential and be used solely for our internal evaluation.

If you have any questions or encounter any issues with the survey, contact us at colleen@thenewmajorityinvest.com.

*P.S. As a special thank you, those who complete survey will receive a 30 9️⃣0️⃣ day free trial of our paid membership.

Reflections from our Founder

I set out on this path to highlight amazing New Majority founders who are currently fundraising from everyday investors.

Selfishly, I wanted to invest in the incredible founders that I work with, read about, and have seen grow through pivots, downturns, and more. As an early stage founder myself, growing a business that I believe will have sustainable and scalable impact, this means I’m not (yet!) paying myself market rate as I’m investing both my time and profits back into the company. But I wanted to invest in other founders, who like me are:

New Majority founders

Building impactful companies with social returns built into the business model

Big visions creating millions of dollars.

This portfolio is the manifestation of that desire and the firm belief that the funding gap for women, BIPOC, and LGBTQ+ founders is horrendously inequitable, but also causing investors to miss out on millions if not trillions in returns (Citi) and overlooking a massive opportunity to create good in this world.

It’s been a journey building a portfolio of earth-changing New Majority founders. 🙌 🙌 Thank you for being on this journey with us.

And thank you for reading (and sharing!) The New Majority Invest!